Serious about Tackling Inequality? Tax Wealth not Work

By Thomas Harrison -

Great Britain, a country which loves to project sophistication and seriousness on the world stage could not be further from it when it comes to the presence of inequality at home.

Wealth inequality in Britain is extreme. The top 10% of households hold around 57% of the nation’s wealth. We live in an era of inflated asset prices and stagnant real wages, yet the treasury continues to place the burden on the country’s grafters instead of redistributing the hoarded wealth of the greedy few. The situation is not only inefficient; it is profoundly unjust.

The story of former Citibank trader Gary Stevenson is an apt one. Son of a post-office worker on £20,000 a year, Stevenson earned more than his father did in his whole life by the time he was 30. Like many of us, Gary grew up perceiving the rich as those on big salaries but as he became rich himself the reality dawned on him: ownership. Owning was the name of the game; assets are taxed vastly more favourably than labour.

In 2016, The Duke of Westminster inherited £9bn; and, due to laws protecting trusts, only paid a fraction of that in tax.

The treasury’s reliance on taxing work is an uneven burden on workers. Taxing wages is reliable. Almost everyone earning a salary will pay what they owe in income tax and national insurance because employees have taxes taken directly out of their pay through PAYE. Alternatively, taxes on wealth such as capital gains and inheritance are only collected when assets are sold or declared, which wealth-holders can delay or avoid.

Wealthy individuals can legally minimise their taxes with the help of professional accountants – an option that is simply not available to most people on modest incomes. Analysis shows that wage earners in the top 1% can expect to pay roughly 49% tax on their salary. In contrast, for those who structure their income around gains from wealth, the effective tax rate for someone in the 1% can be just 27% of income.

HMRC say the tax gap – all unpaid taxes from avoidance, evasion and errors – is around £39-40 billion. Part of that figure is legal tax avoidance schemes which amounted to £1.8 billion in 2022/23. This is revenue that could be funding UK public services. Part of the treasury’s tax levers are two fundamentally regressive taxes: VAT and council tax. Regressive taxes are ones which disproportionately affect those on low incomes. Those on low incomes often pay three times as much in council tax and five times as much in VAT as they do in income tax, since many earn too little to owe much income tax.

Great Britain’s public services are a mess. NHS waiting lists have risen to an all-time high: roughly one in seven people are currently awaiting treatment. In 2023, three English councils declared bankruptcy.

Without additional funding, 43% of local authorities are facing potential insolvency by next year. Across the country evidence of the effects of austerity are plain to see: pothole-riddled streets, shuttered public facilities and basic services simply not fit for purpose. Only serious reinvestment can begin to repair them.

The Institute for Fiscal Studies, a leading economic thinktank, has recommended that the government finds £25 billion in extra tax revenue to end an era of austerity and restore decently funded services. Last year the government ran a £131 billion budget deficit, just shy of 5% of GDP. This means we spent far more than we raised – pretending we can borrow indefinitely is no longer viable due to this limited fiscal headroom. Britain must confront the reality and raise new revenue.

The cost-of-living crisis in the UK means working people cannot bear any more of the load. Energy bills and essential food prices have surged in recent years. It is no surprise that a record 3.1 million emergency food parcels were dispensed from food banks last year. In conditions like these, squeezing ordinary workers for more is morally indefensible. Hiking taxes on work would push many families from hardship into genuine poverty.

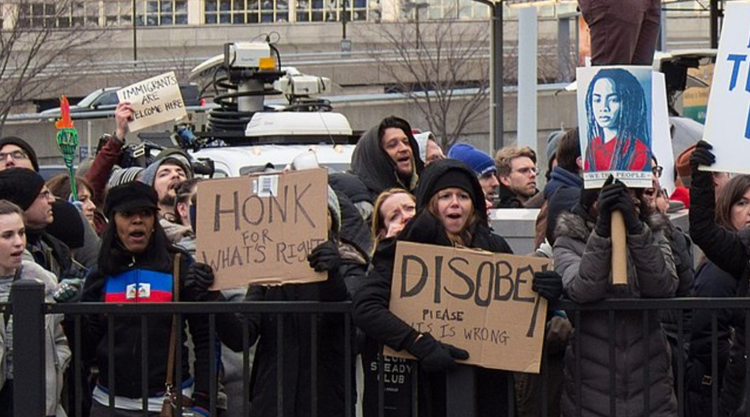

Additionally, imposing another heavy dose of austerity would be socially and politically catastrophic. A report from the Fairness Foundation says that Britain will become more unfair and unequal over the next five years. This is fertile ground for populism and extremism, as disillusioned voters look for those offering scapegoats and simple answers.

Britain has already had a taste of this with Reform, a right-wing, anti-immigration party, collecting 677 new council seats at the 2025 local elections. Their flag-waving rallies and the recent march in London show how the party has moved from the fringes towards the mainstream. Tory defections to Reform only add to their momentum. They are positioning themselves as the party of protest, but one offering little in the way of solutions.

Some argue that taxing wealth more heavily risks “capital flight,” with the wealthy moving assets abroad. But this excuse falls apart on closer inspection. Assets are rooted in Britain because Britain is where the assets are – land, property, and companies cannot simply be packed into a suitcase and flown out of Heathrow. We have already shown our capacity to act decisively in moments of crisis: the government successfully froze and taxed Roman Abramovich’s wealth after the invasion of Ukraine. If we can confront oligarchs then, we can certainly take modest, fair measures against domestic hoarding of wealth

Fortunately, the UK has no shortage of wealth. Overall wealth has exploded to six times the size of the whole economy. Through common sense reforms, we can paint a prettier picture for our future. Starting with equalising capital gains tax rates with income tax, closing egregious inheritance loopholes, and taxing dividends and property wealth more fairly we can target unearned riches rather than hard-earned wages. Experts have suggested that a serious package of progressive wealth taxes could raise tens of billions a year for the treasury.

Britain stands at a crossroads. The choice is clear: continue taxing work excessively, deepening inequality and eroding democracy, or adopt a fairer system where wealth contributes its rightful share. Wealth taxes aren’t just about raising revenue. Instead, they represent a commitment to justice, fairness, and equal opportunity. With Angela Rayner’s resignation and Keir Starmer’s leadership increasingly in question, Labour faces a moment of truth. Reform’s rise shows what happens when the left hesitates: disillusioned voters turn to dangerous alternatives. A serious wealth tax could become the popular alternative to fascism that Labour desperately needs to seize.

If we genuinely care about the society we leave for future generations, it’s time to act decisively. Let’s tax wealth seriously and build a country where fairness isn’t just an ideal, but a reality.

Member discussion